The cash is held with the exact same financial getting comfort

Either way, an underwriter desires to get a hold of enough loans. Do not dip less than which amount of cash required for closing and you can down-payment. It does lead to home financing assertion.

Solution: Separate Profile

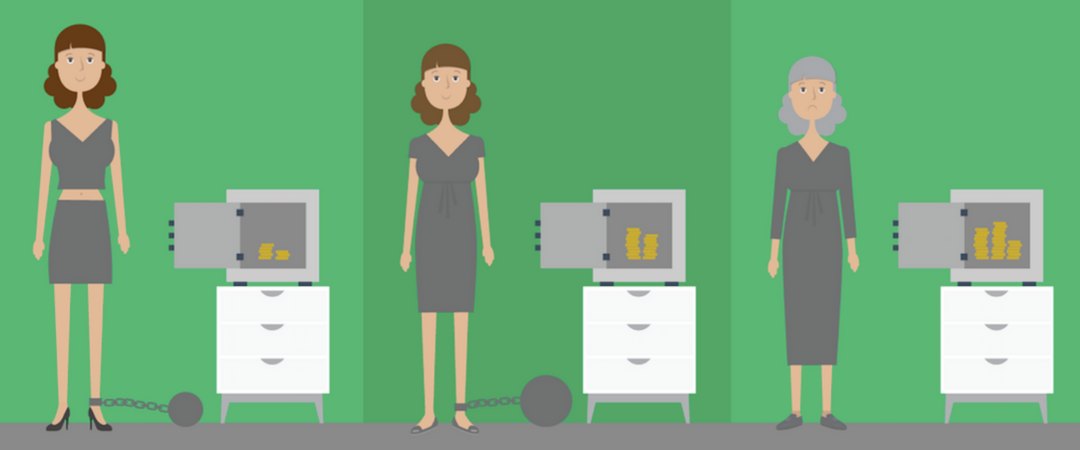

It is smart to keeps an alternate account for your own settlement costs and you will downpayment. Get-off the bucks where membership and do not reach the fresh new money.

Particularly, of a lot banks promote a verifying and you can bank account. Stop having your settlement costs and you will downpayment commingled together with your relaxed family savings.

Or even, your chance overspending and you may dipping into funds for closing. The greater number of barriers you might developed, the better. For those who have a difficult time handling their expenses, imagine placing the cash during the a unique savings account entirely.

Regarding property techniques, envision causing the deals to make more pillow. People fund leftover shortly after closure are used for to buy the new chairs, and work out repairs, or other costs you might incur just after closing for the a house.

Alterations in A position Or Earnings

Your profession while the balances of the profession are a varying underwriters use to assess their chance rating. Changing operate or markets you are going to enhance your chance get and increase the chances of bringing declined immediately after pre-recognition.

All the financial and you will mortgage variety of varies about what he could be happy to just accept when it comes to alterations in a job. Before making people community behavior, it is advisable to check with your mortgage lender in addition to prospective effects on your own pre-approval.

A general change in a career is appropriate if it is for the a great comparable community. Instance, a buyer who’s a registered nurse switches medical facilities, but remains a nurse which have a comparable money.

Like, when your rn decides to be a teacher otherwise an excellent fitness representative, there is certainly a high probability you to a lender often deny this new financing and need you to definitely start new pre-approval processes once again.

Solution: Continue Secure Work

If you are planning to make huge profession actions, propose to do it immediately after closing on your own domestic. If not, speak to your mortgage lender through to the disperse.

In some instances, homebuyers gets let go from their work from inside the homebuying procedure. If it happens, discover a career in the a similar industry along with an equivalent company. Along with, notify the bank in such a circumstance.

Bank Direction Change

When the total market change otherwise a special Chief executive officer happens board, you’ll be able to to your lender to improve the financing direction

Such as for example, with rising rates of interest, of numerous loan providers are getting stricter on their guidelines so that they can sell brand new mortgages throughout the additional sector. When you look at the highest interest places and you can field suspicion, banks turn to offload the funds to your supplementary industry.

To market its financing, they have to issue funds that will be attractive. This means that, they accept funds that have smaller exposure.

For-instance, a lender can get agree funds which have a loans-to-money proportion regarding forty %, however they apply guidelines to simply accept loans in financial trouble-to-money rates less than 30 %.

Even although you performed nothing wrong to boost your risk, the financial institution decided your own chance is actually excessive underneath the this new advice.

There are not any particular solutions for coping with this case when the it occurs. You can stick to the tips a lot more than to attenuate your general exposure photo, see another type of lender, or button mortgage types.

Assessment Items

Most financial pre-approvals is conditional on a suitable personal loans Delaware financial assessment. Definition, the home should see particular criteria and guidance.

Such are different based on lender and you will mortgage type. For example, a beneficial USDA mortgage are only able to loans the purchase out-of a house within the a medication USDA region. An excellent MSHDA mortgage with a $ten,000 down-payment assistance is simply approved for the certain zero rules.