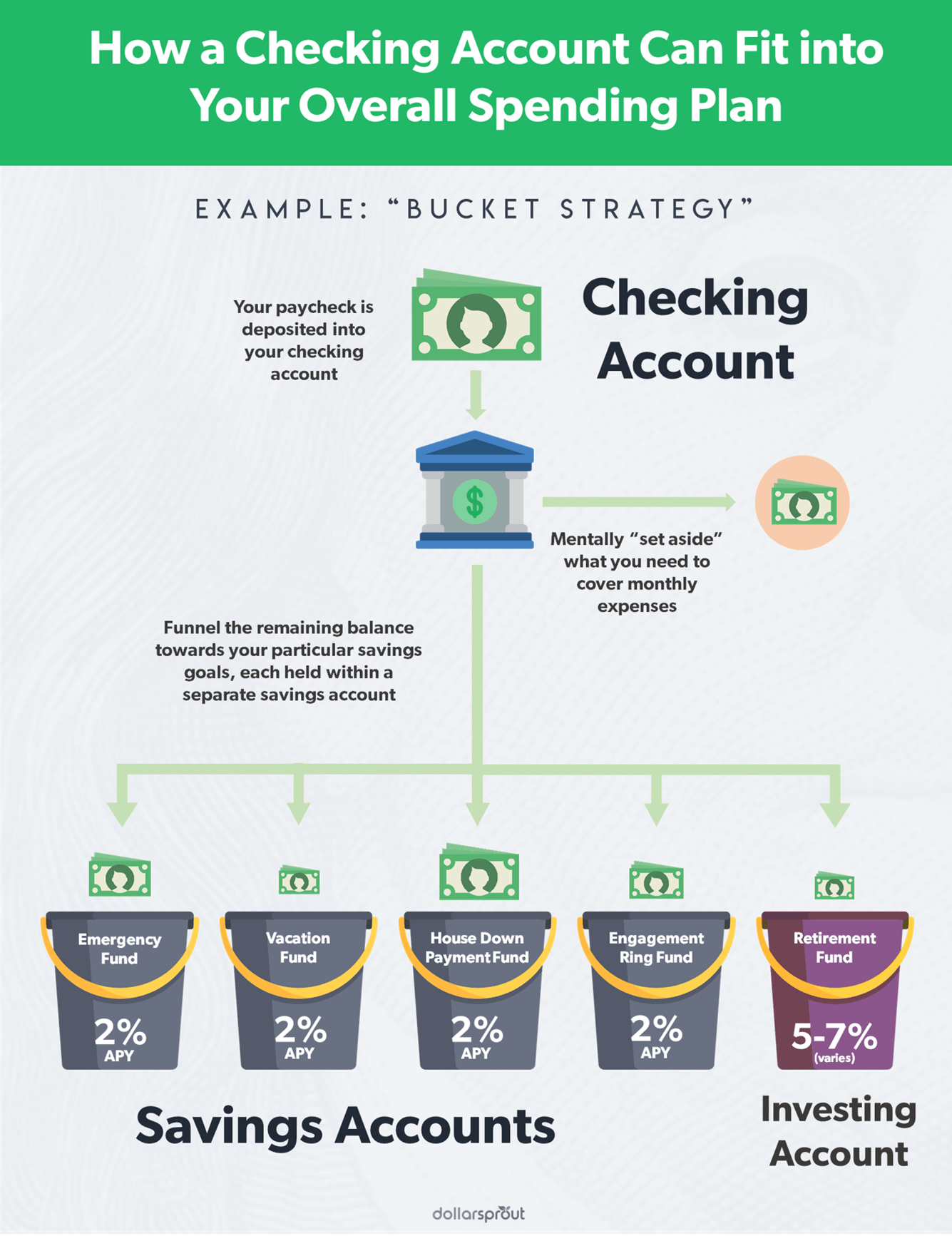

Having large money, they could require also equity, eg a home or a vehicle

You will find several important terms and conditions you to definitely influence how big is an excellent mortgage as well as how easily the borrower will pay they back:

- Principal: This is the fresh amount of money that is are lent.

- Loan Name: The amount of time the debtor needs to pay brand new mortgage.

- Rate of interest: The pace from which how much money due grows, constantly indicated in terms of an annual percentage rate (APR).

- Loan Costs: What kind of cash that needs to be paid back monthly otherwise day to generally meet the terms of the loan. In line with the prominent, mortgage label, and you may interest rate, this will be calculated of a keen amortization desk.

Concurrently, the lending company may also tack to your additional charge, instance a keen origination commission, upkeep commission, otherwise later fee costs. If the borrower non-payments with the loan, such possessions tends to be caught to repay the remaining financial obligation.

Guidance on Getting financing

So you’re able to be eligible for a loan, possible individuals have to show that he’s the ability and you may financial abuse to repay the lending company. There are many things one lenders believe when choosing when the a beneficial sorts of borrower may be worth the chance:

- Income: For larger funds, loan providers may need a specific earnings threshold, and therefore making certain the fresh new debtor get no trouble making costs. They might also require numerous years of stable work, especially in the actual situation out of home loans.

- Credit history: A credit history try a numerical symbolization out-of somebody’s creditworthiness, according to the history of borrowing from the bank and you can cost. Overlooked costs and bankruptcies can lead to really serious damage to a person’s credit score.

- Debt-to-Income Ratio: In addition to an individual’s money, loan providers plus see the borrower’s credit score to test just how many energetic money they have at the same time. A more impressive range away from debt demonstrates that the brand new borrower might have challenge paying down the debts.

In order to boost the threat of being qualified for a financial loan, it is essential to prove that you may use obligations sensibly. Pay off their financing and credit cards timely and avoid taking to the people way too many debt. This will together with meet the requirements you having straight down interest levels.

It is still it is possible to so you can qualify for finance for those who have enough obligations or a woeful credit score, nevertheless these will incorporate increased rate of interest. Since these funds tend to be more costly finally, youre much better from looking to change your fico scores and obligations-to-money ratio.

Matchmaking Ranging from Rates and Fund

Rates keeps a significant influence on finance together with ultimate prices on debtor. Money that have high interest rates provides large monthly payments-or take expanded to settle-than loans having all the way down interest levels. Eg, if an individual borrows $5,000 on the an excellent five-year payment or identity mortgage with a 4.5% rate of interest, it face a payment per month away from $ for the next 5 years. In contrast, in case the interest are nine%, the repayments rise so you can $.

Large rates incorporate higher monthly payments, meaning they take more time to settle than simply money with down cost.

Furthermore, if a person owes $ten,000 to the a credit card that cash advance in Victoria have a 6% interest rate and pay $2 hundred per month, it requires all of them 58 months, or nearly 5 years, to settle the bill. Which have an effective 20% rate of interest, an equivalent balance, plus the exact same $two hundred monthly installments, it entails 108 weeks, otherwise 9 years, to pay off this new credit.

Simple vspound Desire

The pace towards fund shall be lay at the easy otherwise substance interest. Easy attention was interest on the dominating financing. Banks almost never fees individuals effortless notice. Such as for example, imagine if one takes out a beneficial $three hundred,000 mortgage about financial, in addition to loan arrangement states that the interest rate to the financing was fifteen% per year. This is why, new debtor would have to pay the bank a maximum of $345,000 otherwise $300,000 x step one.fifteen.